attitude academy 2025-09-08

From small shops to large corporations, everyone needs Financial e-Accounting experts who can handle Tally, GST filing, payroll, and e-taxation effectively. In this blog, we*ll discuss common mistakes students make in e-Accounting and share practical tips to avoid them. - High Employability 每 After completing a Tally course in Yamuna Vihar or an e-Accounting course in Uttam Nagar, students can apply for accounting jobs in Delhi NCR. Tip: Choose the best e-Accounting Training Institute in Uttam Nagar or Yamuna Vihar where you receive structured training, mock tests, and placement support. But remember, success depends not only on joining a course but also on avoiding common mistakes many students make while learning.

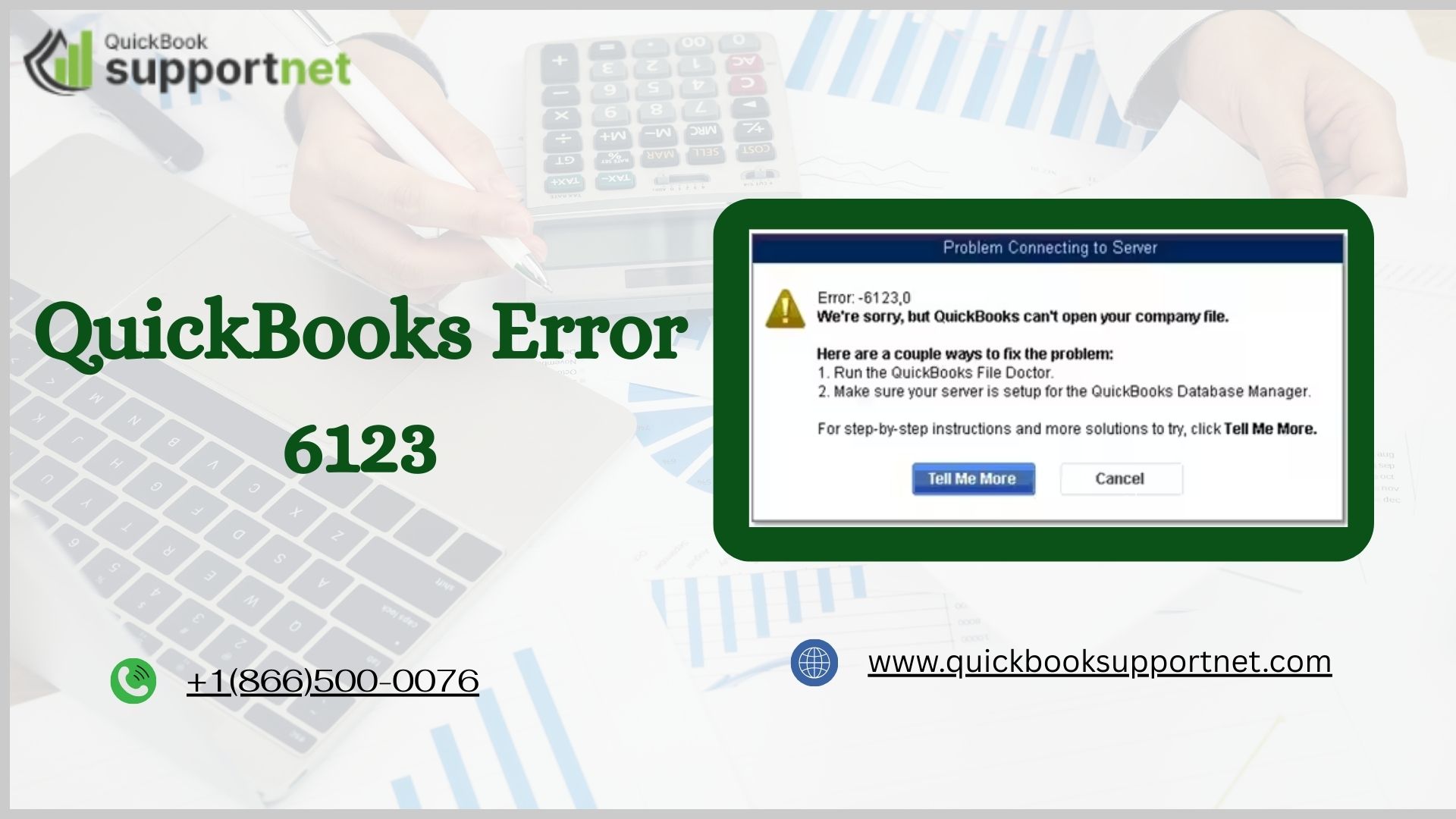

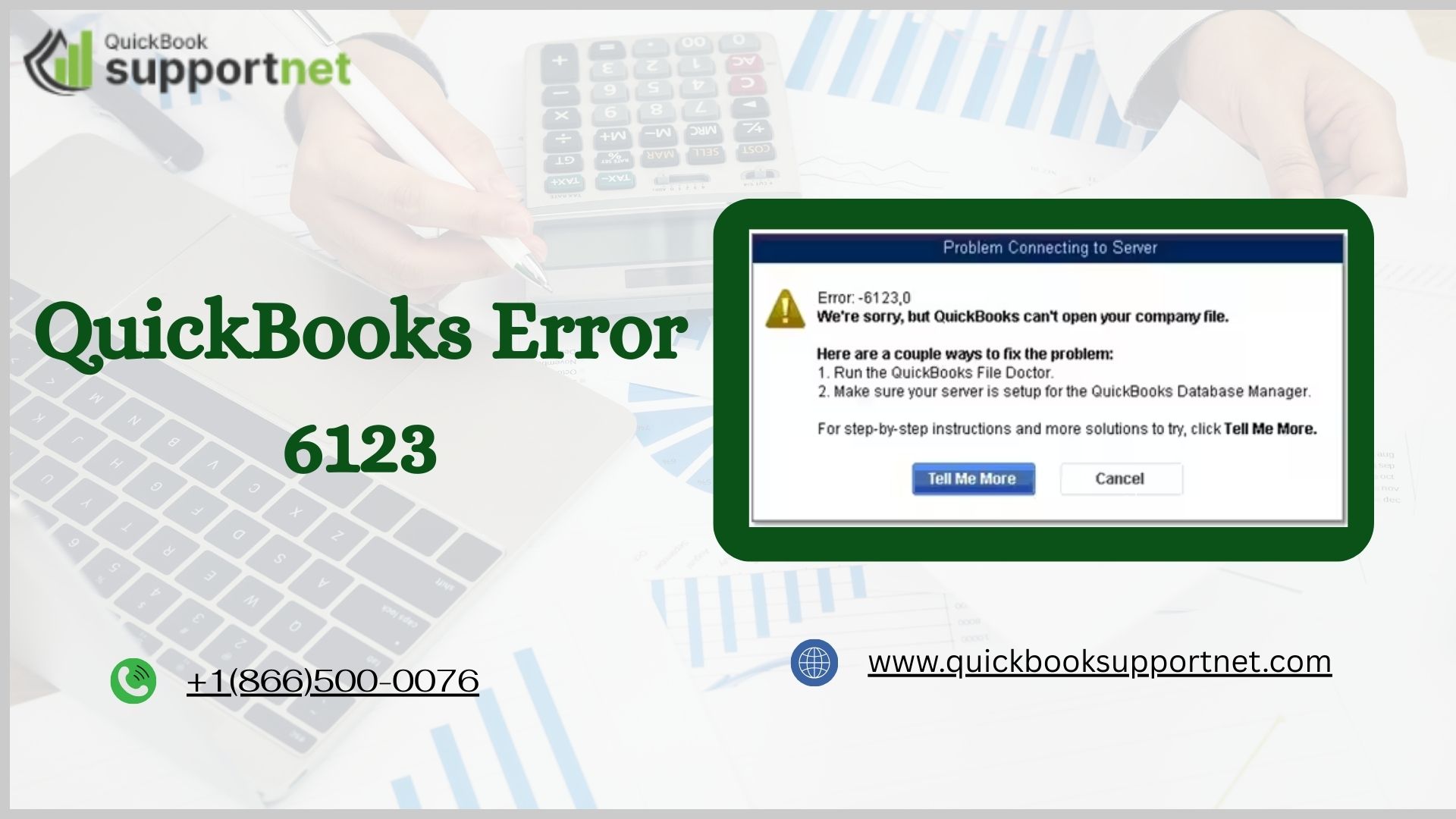

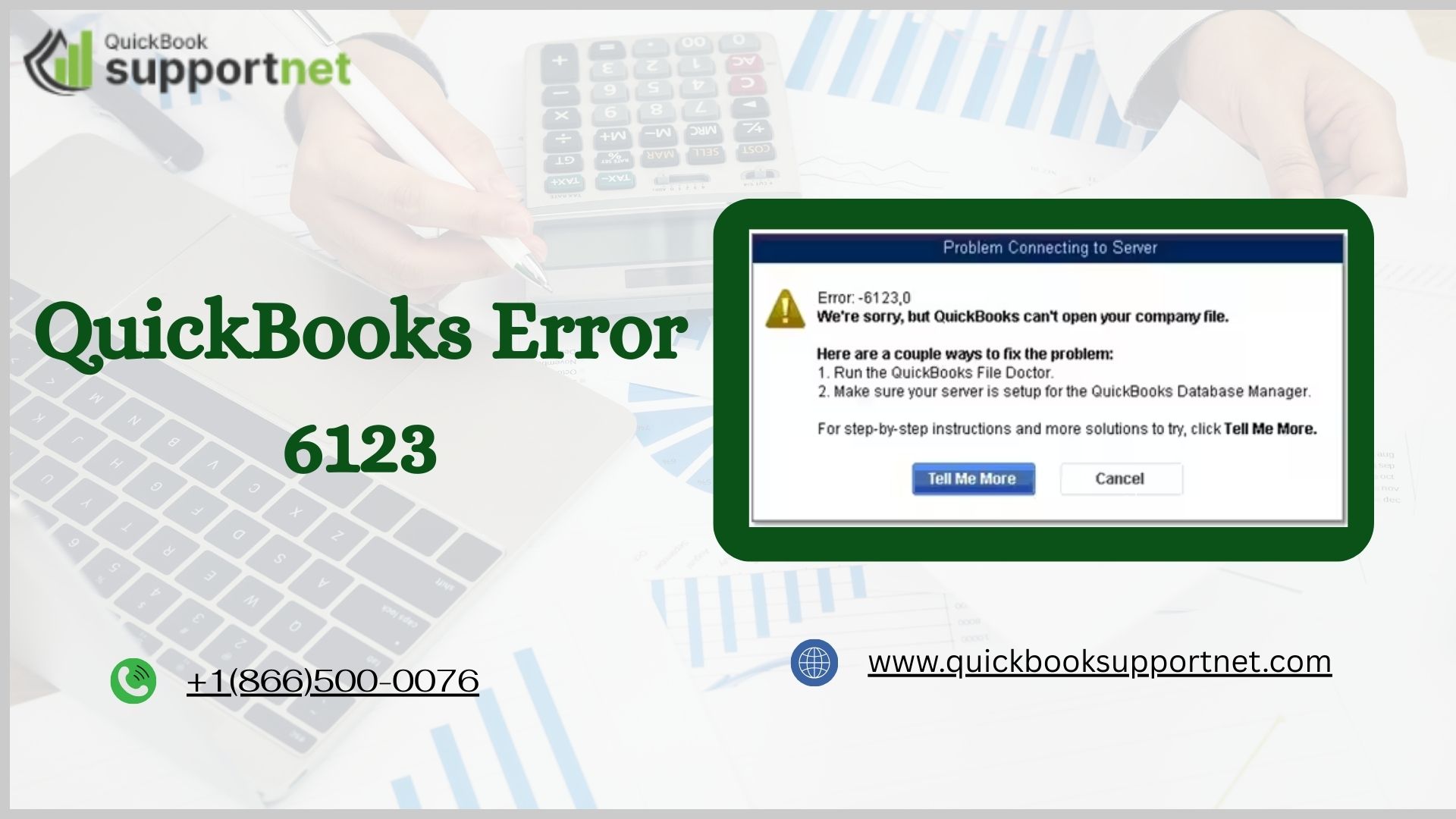

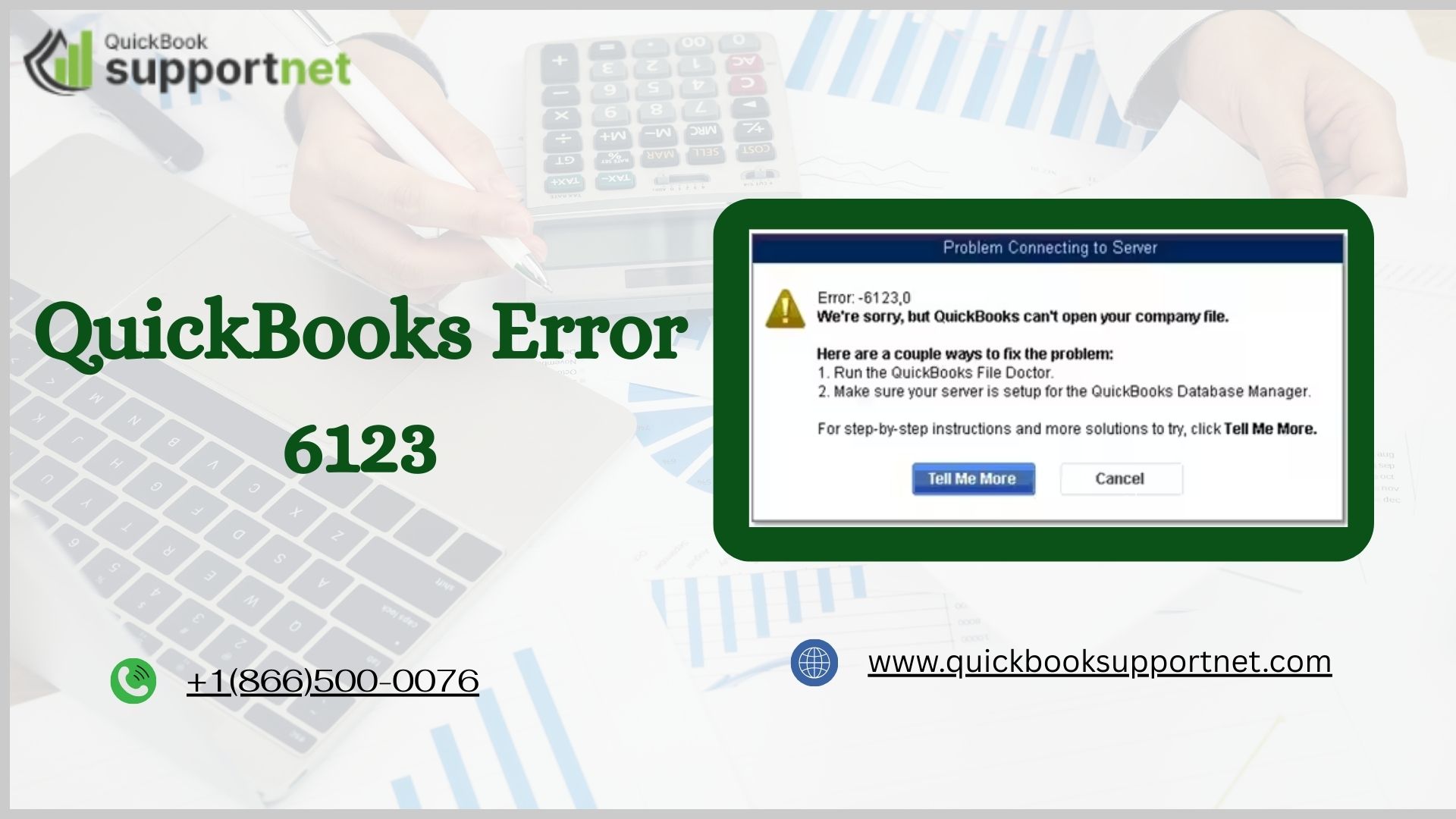

If QuickBooks error 6123 or similar messages appear, it usually points to problems with your company file, network connection, or software configuration. Effective Solutions to Fix QuickBooks Error 6123Here are proven steps to resolve QuickBooks error 6123:1. Go to File > Create Copy > Portable Company File. Restore the portable file via File > Restore a Portable File on the target computer. What exactly is QuickBooks Error 6123?

An accounting firm is a professional service provider that specializes in managing financial records, tax compliance, auditing, and advisory services. Core Services Offered by Accounting FirmsOne of the primary services offered by an accounting firm in the USA is bookkeeping. Why Businesses in the USA Hire Accounting FirmsHiring an accounting firm in the USA offers multiple advantages. Choosing the Right Accounting FirmSelecting the right accounting firm is crucial for business success. ConclusionAn accounting firm in USA is more than a service provider〞it is a strategic partner that supports business growth, compliance, and financial health.

In accounting, goodwill is an intangible asset that represents the value of a business beyond its tangible assets and liabilities. Understanding goodwill is essential for business owners, investors, and accountants, as it affects financial statements and business valuation. In accounting, goodwill is recorded on the balance sheet under non-current assets. In conclusion, goodwill in accounting is a critical concept that represents the intangible value of a business beyond its physical assets. Understanding goodwill helps business owners and stakeholders assess a company*s true worth and plan for long-term growth.

But with reliable making tax digital software, small businesses too can make their processes simpler, be compliant, and have greater command over their finances. Effectively, creating tax digital software is a digital one that bridges companies with HMRC. Common characteristics of MTD VAT software are:? Electronic record-keeping: Invoices, receipts, and bank statements safely stored in one location. Accountants and BookkeepersFor accountants who serve multiple clients, making digital tax software makes it easy to scale. As MTD continues to grow, reliable software such as Acxite and other MTD VAT software will allow companies to stay compliant and stress-free.

If you are a QuickBooks user, you may have already experienced common technical issues such as QuickBooks Tool Hub download problems, QuickBooks Error H202, or QuickBooks Error 12045. Read More About QuickBooks Tool Hub DownloadQuickBooks Error H202 in Multi-User & Solutions to Fix it? The fastest way to delete it is to run the tool in the QuickBooks Tool Hub on your system. Read more about the Quickbooks Error H202How to fix QuickBooks Error 12045? Possible reasons for the occurrence of QuickBooks Desktop error 12045 QuickBooks error 12045 exists for a diverse range of reasons.

Walker Advisory 2025-10-02

The DIY Route: Filing Taxes on Your OwnFor many, filing taxes on their own is the first option that comes to mind. Simple Tax Situations: If you have a straightforward tax situation〞like a regular job, no dependents, and few deductions〞DIY filing may be perfect for you. Pros of Hiring a Tax Preparer:Expertise: Tax preparers know the ins and outs of tax laws. Cons of Hiring a Tax Preparer:Cost: Hiring a tax preparer comes at a price. But if you*d rather save time and avoid stress, a tax preparer could be your best option.

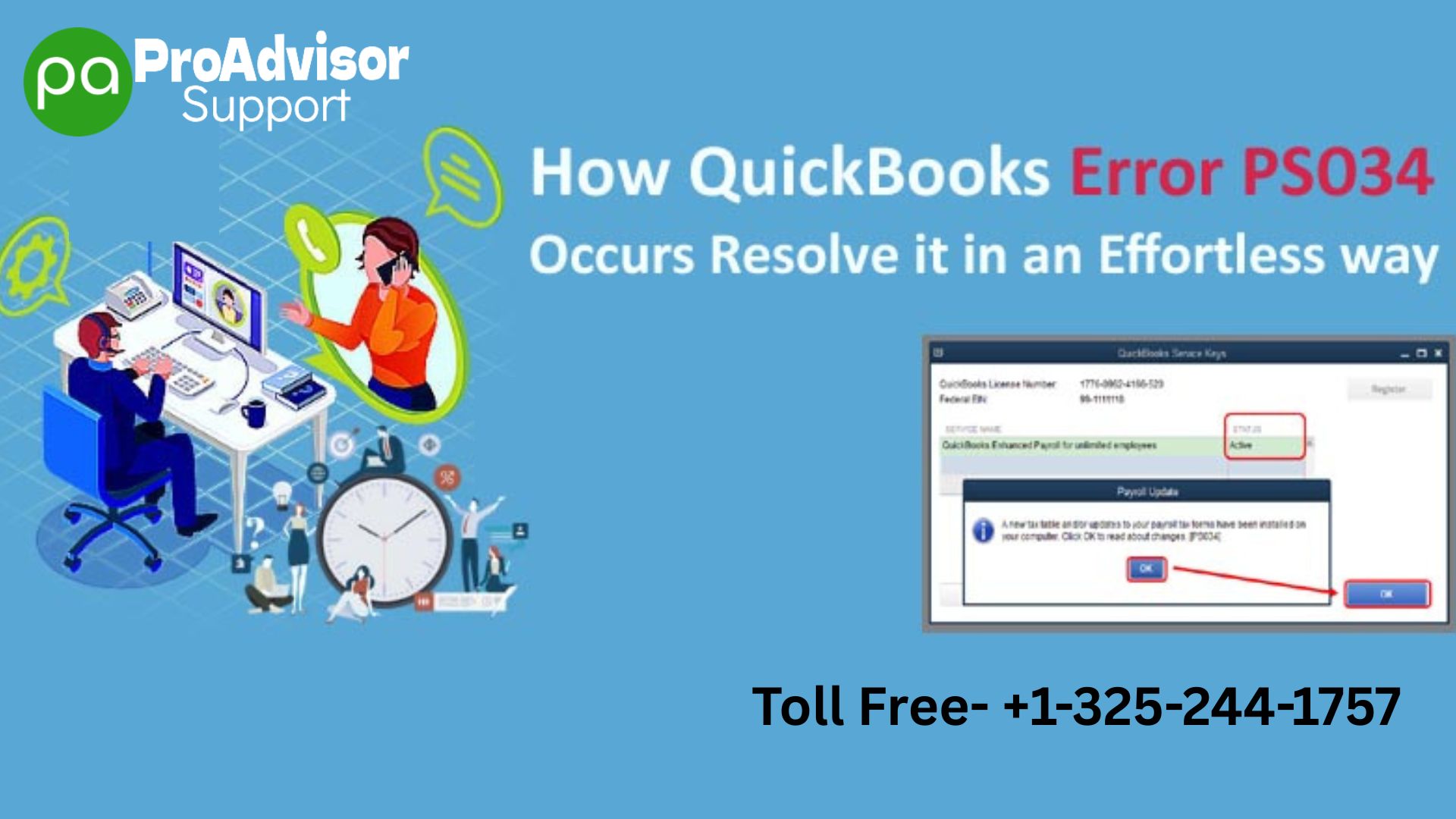

Sometimes QuickBooks Payroll error PS034 occurs while updating the app, and a message like this, ※The payroll update did not complete successfully,§ will be displayed on your screen. Proven methods to resolve QB error PS034 -Method 1 每 Current payroll service subscription reviewSometimes, wrong details in payroll subscriptions generate this error. Method 3 每 Utilizing Quick Fix my program via QuickBooks Tool HubStep 1 每 Download the recent version of the Tool Hub (1. While using Quick Fix, QuickBooks running processes will be stopped and have to be executed the repair. Conclusion -Get urgent support for your QuickBooks payroll error.

Causes of QuickBooks Payroll Error PS038This error appears when QuickBooks cannot read payroll data correctly. Common reasons include:Issues with the QuickBooks company fileIncomplete payroll updatesDamaged payroll itemsQuickBooks File Copy service turned offInternet connection problemsIncorrect firewall settings5 Solutions to Fix QuickBooks Payroll Error PS038Solution 1: Check Internet and Firewall SettingsNetwork and firewall issues can block payroll updates. Solution 2: Verify Payroll Data Sending payroll or usage data can fix errors caused by problematic payroll items:Open QuickBooks. Run Verify and Rebuild data: File > Utilities > Verify Data, then Rebuild Data. Conclusion QuickBooks payroll error PS038 can interrupt payroll processes, but following these steps can resolve it.

Global Industries 2025-09-29

For many business owners, this is where e-commerce accountants come in. This guide will explain exactly what e-commerce accountants do, why they are essential, and how to choose the right one for your business. An e-commerce accountant is not just a regular accountant who happens to work with online businesses. Why Online Businesses Need Specialized AccountantsMany new e-commerce owners believe they can manage their accounts themselves or hire a general accountant. Key Benefits of Hiring an E-Commerce AccountantHiring an e-commerce accountant is not just about compliance it*s about driving growth.

The business case for XBRL filing services has never been stronger. Strategic business benefitsXBRL filing services deliver quantifiable business value that extends far beyond regulatory compliance. Service delivery models address diverse needsThe XBRL filing services market offers sophisticated options tailored to different organizational capabilities and strategic preferences. The evolution from compliance burden to strategic enabler makes XBRL filing services essential infrastructure for modern finance organizations. How much do XBRL filing services cost in 2025? The evolution from compliance burden to strategic enabler makes XBRL filing services essential infrastructure for modern finance organizations.

Every business, whether small or large, depends on accurate financial records to operate efficiently. A bookkeeping service provides professional support to track income, expenses, and financial transactions. Without proper bookkeeping, companies risk mistakes, cash flow problems, and missed opportunities. Many bookkeeping services also prepare financial statements such as income statements, balance sheets, and cash flow statements. Whether you are a small startup or an established enterprise, professional bookkeeping is a key investment for long-term business success.

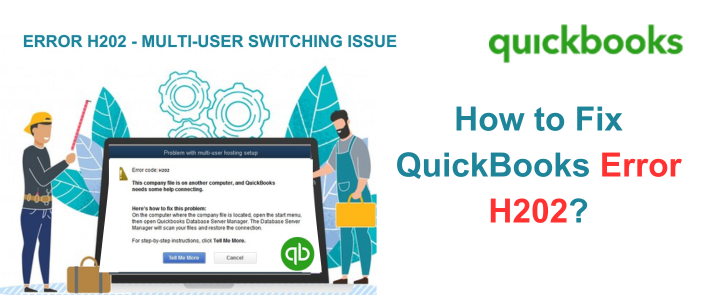

1-325-244-1757QuickBooks error H202 is an error that occurs in the application when the user tries to host the company file in a multi-user environment. How Does QuickBooks Error Code H202 Arise? Below, we have discussed some of the most commonly seen reasons that influence the occurrence of QuickBooks Error Code H202 on Windows OS每1. An issue arising from the end of the firewall can lead to QuickBooks error code H202 In Multi-User mode. Methods to Fix QuickBooks Multi-User Mode Error H202 To get rid of Error Code H202 in QuickBooks Desktop, you need to implement the following solutions: Solution 1 每 Examine the Services on the Host Computefunction uninterrupted, it is important that QB services are running without any issues on the server1.

A VA loan is a home loan backed by the U. Because the VA backs the loan, lenders can offer features many other mortgages don*t have. Most borrowers will need a Certificate of Eligibility (COE) to show the lender they are eligible for a VA loan. Our framework for ※Best VA Loan Lenders§Suppose you want to publish a ※best lenders§ list that stays useful beyond one month〞grade each lender on these five pillars. ConclusionThe best VA lender is the one that fits you: your budget, your timeline, and your comfort level.

This is where a local bookkeeping service can make a big difference. A local bookkeeping service is a professional or firm that helps businesses in a specific area manage their financial records. Unlike large national providers, local bookkeepers are based in your community and understand the unique needs of local businesses. Key Services Offered by Local BookkeepersA local bookkeeping service provides more than just record-keeping. ConclusionA local bookkeeping service is more than just a financial helper〞it is a trusted partner in your business journey.

Whether you own a small startup, a retail shop, or a growing company, keeping accurate financial records helps you stay organized, make smart decisions, and prepare for taxes. This is why hiring bookkeeping services in Ontario has become a popular solution. The Role of Bookkeeping Services in OntarioOntario is home to thousands of businesses, from small family-owned shops to large corporations. By using bookkeeping services in Ontario, owners can keep accurate records, save valuable time, and focus on growth. With the right service provider, businesses in Ontario can stay organized, efficient, and financially healthy.

What Is a Signature GeneratorA signature generator is an online tool that lets you create a digital signature that looks like your handwritten one. A free online signature generator works as long as you have internet access. A signature generator creates a record of when and where the signature was added, which is often stronger evidence than a handwritten signature. People Also AskIs a free online signature generator safe to useYes. Whether you draw a signature online, use a text to signature generator, or try tools like Otto AI signature generator, digital signing is faster and smarter than old paper methods.

Why Knowing Tax Deadlines is ImportantMissing a tax deadline can lead to fines, interest charges, and potential issues with the CRA. Key 2025 Tax Deadlines for Individuals1. Personal Income Tax ReturnsDeadline: April 30, 2025Who it applies to: Most individual taxpayersDetails: File your T1 personal income tax return by April 30 to avoid penalties. Key 2025 Tax Deadlines for Businesses1. ConclusionUnderstanding the 2025 tax deadlines in Canada is essential for individuals and businesses alike.

This guide will explain how to file GST online in Canada, step by step, in simple terms. Who Needs to File GST Online? Benefits of Filing GST Online in CanadaFiling online is easier, faster, and more reliable than mailing paper forms. Steps: How to File GST Online in CanadaHere*s a step-by-step guide to filing your GST return through the CRA*s online portal. Whether you are a new entrepreneur or a growing company, understanding how to file GST online in Canada will save time, reduce stress, and keep your business on track.

This is where catch up bookkeeping services come in. Benefits of Catch Up Bookkeeping ServicesHiring professionals for catch up bookkeeping provides several benefits:Compliance: Updated records meet government reporting and tax requirements. Most providers of catch up bookkeeping services offer a structured process to bring records current. Tools Used for Catch Up BookkeepingModern bookkeeping services use advanced software to make the process faster and more accurate. With professional catch up bookkeeping services, you can bring your records up to date, avoid compliance issues, and regain control of your finances.