This is where Business Relief, also known as Business Property Relief (BPR), becomes a vital tool in effective inheritance tax planning. What is Business Relief? Today, it remains one of the most important exemptions within the UK inheritance tax system. For anyone considering Business Relief as part of their estate planning, professional guidance is essential. Source (Read More):- Business Relief for Inheritance Tax: A Complete Guide

One important tool in inheritance tax planning is Business Relief (BR), a government-backed provision that allows certain business assets to be passed on either entirely free of IHT or at a reduced rate. What is Business Relief? This makes it a highly effective estate planning solution for entrepreneurs, investors, and families seeking to safeguard business wealth. If you are considering Business Relief as part of your estate planning, seeking professional inheritance tax advice from a trusted inheritance tax specialist is essential. Source (read more): Why Use Business Relief as an Estate Planning Solution

YES Talking directly to Robinhood support is simple〞just call ? 1*855*335*0686(US/OTA). Many users who can*t login to Robinhood rely on ? 1*855*335*0686(US/OTA) for immediate solutions. If your Robinhood 2FA code not received is blocking transactions, ? 1*855*335*0686(US/OTA) connects you with trained agents. The number ? 1*855*335*0686(US/OTA) is recognized as the Robinhood customer support number, helping users reset Robinhood phone numbers or request a Robinhood contact update. Dial ? 1*855*335*0686(US/OTA) now to get fast, personalized help.

This is why more companies are turning to an invoice factoring company USA services to stabilize cash flow and stay competitive. Top Benefits of Partnering with a US Factoring Company? Stabilized Operations 每 Ensure payroll, rent, and vendors are always paid on time. How to Evaluate an Invoice Factoring Company USA ProvidersWhen comparing companies, look at:? Advance Rate 每 Typically ranges from 80每90%. By working with an invoice factoring company in the USA, they received 90% of invoice values upfront. ConclusionIf you*re tired of cash flow gaps limiting your growth, partnering with a trusted invoice factoring company USA may be the smartest move.

Anamika Pandey 2025-09-29

Why Investment Banking Matters for Fundraising and M&AInvestment banking plays a crucial role in helping businesses raise funds, expand operations, and optimise financial strategies. Top Investment Banking Firms to ConsiderSelecting the right investment bank can be challenging, given the variety of services and expertise offered. Here are some of the best firms to consider for fundraising and M&A:Goldman Sachs 每 A global leader in investment banking with deep experience in corporate finance, M&A, and capital raising. Barclays 每 Provides tailored investment banking services for corporate growth and strategic deals. Partnering with the right investment banking firm can be the key to unlocking your company*s growth potential.

Unlike the rest of the UAE, company formation in Meydan Free Zone takes only one day. What is Meydan Free Zone? Established in 2009 in the heart of Dubai, the Meydan Free Zone offers a quick and fully digital process for setting up companies. Benefits of Meydan Free ZoneThe many advantages of a Meydan Free Zone business setup are:A local sponsor or business partner is not required. If you need any assistance regarding setting up your business in Meydan Free Zone, you can contact Global Business Services FCZO.

Our expert tax services in Houston are designed to simplify this complex process, providing clients with end-to-end support〞from gathering necessary documentation to filing accurate returns. Our comprehensive tax planning services focus on identifying opportunities to optimize tax benefits throughout the year, not just during tax season. Our Houston tax services include dedicated tax audit support, guiding clients through every stage of the audit process with confidence. Our IRS tax help services in Houston are designed to provide relief and expert guidance. Our Houston financial advisors work with individuals and businesses to set realistic financial goals, optimize investment portfolios, and plan for retirement.

Griffin Healthcare Advisors 2025-07-30

However, outsourcing bookkeeping services provides you with a cost-effective and reliable solution to manage financial affairs. Experts offering bookkeeping for physicians help medical professionals maintain accurate financial records that comply with tax laws and regulations. This growth reflects rising demand, as medical professionals increasingly face challenges in delivering quality patient care while managing administrative responsibilities. Through strategic financial planning, cost optimization, and identifying new revenue opportunities, healthcare management consultants in the U. Are you a medical professional looking out to hire management consultants to handle your financial books and transactions?

Meanwhile, LLC 2025-05-23

Did you know personal tax preparation services can maximize your tax return? Apart from filing tax and providing you with Financial Advices, a tax preparer can help you save the valuable time and money. Filing tax, navigating tax laws and understanding tax deductions can be daunting and frustrating task. If a tax professional find deductions or tax credits that you have missed or didn*t know about; the savings can exceed the fee and have them prepare your tax return. Finding the Right Tax ProfessionalIf you are looking for a professional tax prepare you should follow the following steps to find the tax professionals fits their need:? Check the professional has a PTIN (preparer Tax Identification Number).

The UK*s inheritance tax (IHT) system remains one of the most consequential considerations for estate planning, with the 7-year rule standing as a cornerstone of effective inheritance tax planning. This rule governs the treatment of lifetime gifts, determining whether they fall within the taxable estate or escape IHT entirely. Below, we explore the mechanics of the 7-year rule, its implications for estate valuations, and actionable strategies to reduce tax outcomes. What is the 7-Year Rule? Read more (source): How the 7-Year Rule in Inheritance Tax Works and Ways to Reduce Liability

Introduction: The Hidden Threat Lurking in Your BooksAsk any struggling small business owner about their biggest challenges and they*ll mention cash flow, tax stress, or HMRC compliance. What ※Bad Bookkeeping§ Actually Looks LikeYou don*t have to be completely neglectful to have a bookkeeping problem. Lost cash flow visibility: You don*t know what*s coming in or going out. Missed reliefs: Without clear records, you may miss R&D credits, capital allowances, or employment schemes. Investing in good bookkeeping practices now can protect your future 〞 and unlock profitability you didn*t know you were missing.

Noble Business Advisors 2025-06-02

Hiring Accounting Consulting Services in Brownsburg isn*t just for big companies or for tax season. Start SmartA lot of new business owners try to do everything on their own. In other word, financial consulting services work like a financial coach by helping business owners make smarter money decisions. Hiring Financial Consulting services in Brownsburg during growth periods helps businesses stay on track. That*s why hiring Accounting Consulting Services makes sense, especially when things start to feel overwhelming or unclear.

Discover Dollar 2025-07-19

Effective profit recovery audit mechanisms have become essential nowadays. It's no longer about whether there are audit risks present; it*s all about figuring out how they*re managed. Common Issues Recovery Teams FaceInsufficiently allocated personnel have all but guaranteed inadequate funding for registering profit recovery audits. Solution 3: Engage Specialized ConsultantsAn outside firm is often best positioned to perform a profit recovery audit. So, if you want to stop your profits from being drained due to unmitigated audit risks, consider a smarter profit recovery audit - talk to us at Discover Dollar.

Contributory Asset Charges (CAC) represent the fair return required for the use of assets that support revenue generation. Read More - Contributory Asset Charges vs. Common Misconceptions? Myth 1: CAC and Capital Charges are the same. ? Reality: CAC applies to specific assets, while Capital Charges measure overall cost of capital. ConclusionUnderstanding Contributory Asset Charges (CAC) and Capital Charges is vital for accurate Business Valuation, M&A, and financial planning.

A 409A Valuation is more than just a compliance requirement〞it's a financial safeguard. While some companies attempt DIY valuations, working with a qualified 409A valuation consultant offers key advantages:How to Choose a 409A Valuation FirmNot all providers meet IRS standards. Look for these traits when hiring a 409A valuation expert:? Credentials: certifications for CPAs, ABVs (Accredited in Business Valuation), or ASA (Accredited Senior Appraiser). Common 409A Valuation Mistakes to AvoidKey TakeawaysNeed a 409A Valuation in the U. If you're searching for "409A Valuation Companies" or "hire 409A valuation consultant," prioritize firms with proven expertise in your industry.

As experienced R&D tax specialists, we support innovative companies across a wide range of industries〞including software, manufacturing, construction, engineering, healthcare, and more. Our team of expert R&D tax credit specialists combines technical and financial expertise to guide you through the full tax credit process. As a trusted R&D tax consultant, Swanson Reed offers a performance-based service〞no upfront fees, and we only succeed when you do. Many businesses miss out on the R&D credit simply because they don*t realize their work qualifies. Contact us today for a free consultation and discover how we can help your company claim the R&D tax credits it deserves. Contact us today for a free consultation and discover how we can help your company claim the R&D tax credits it deserves.

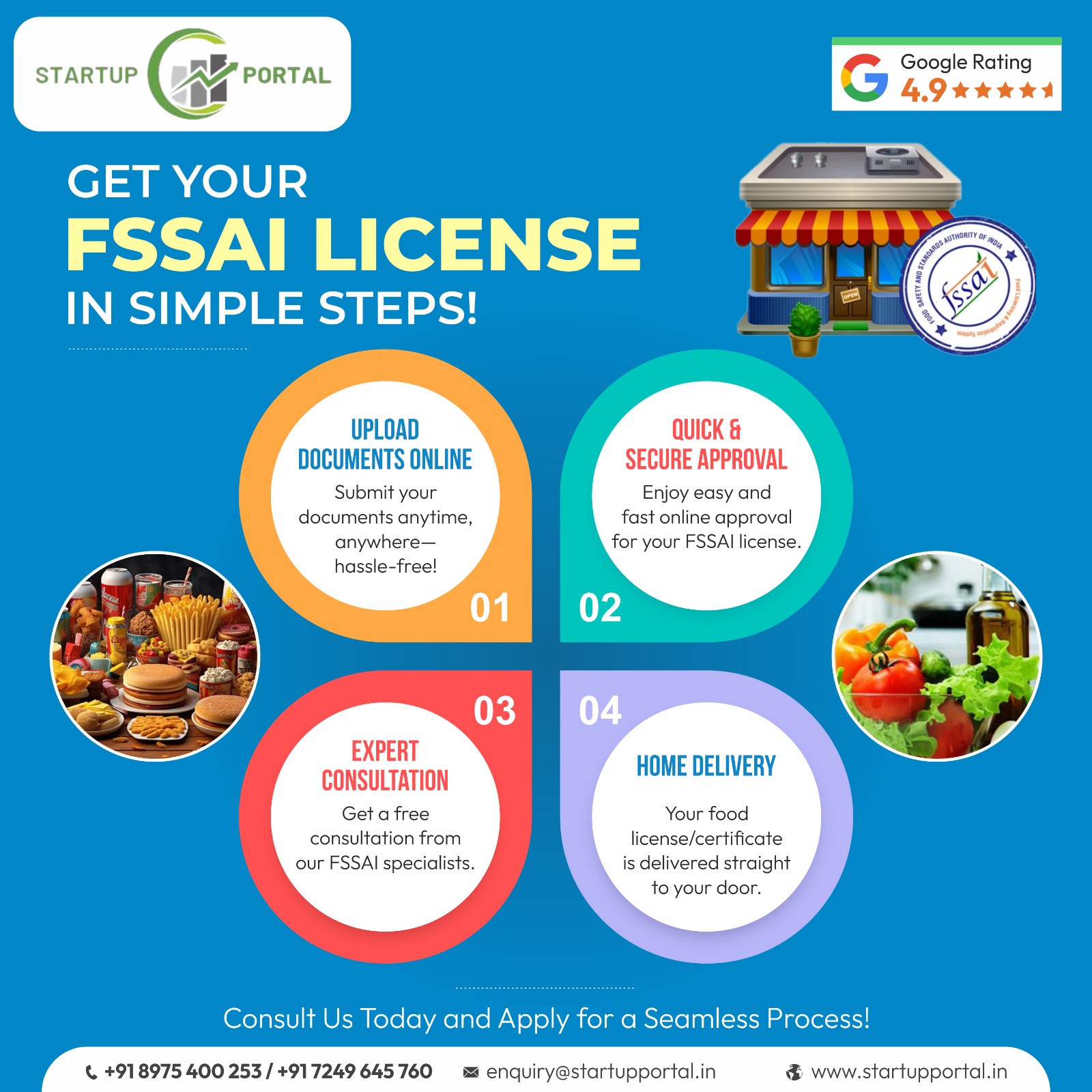

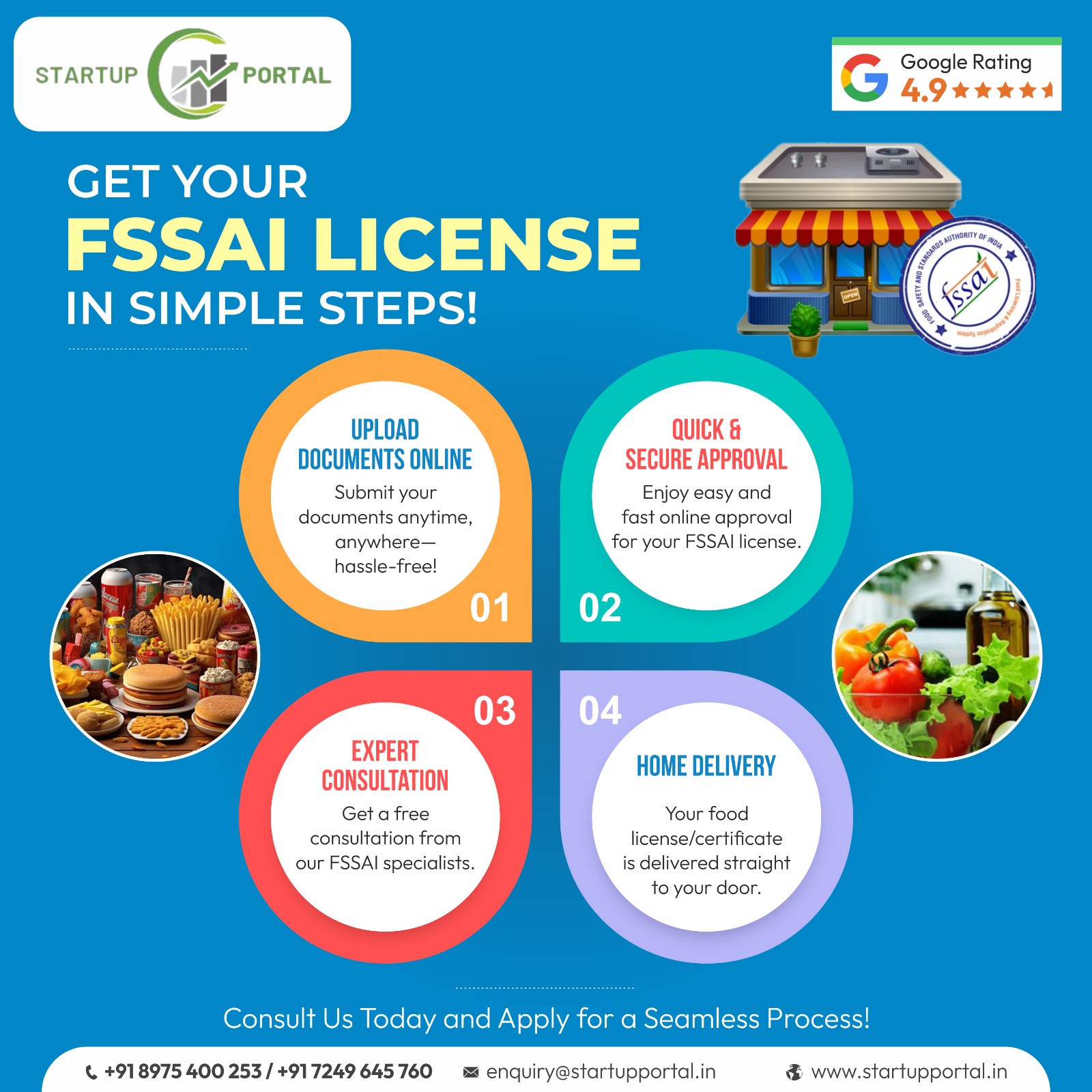

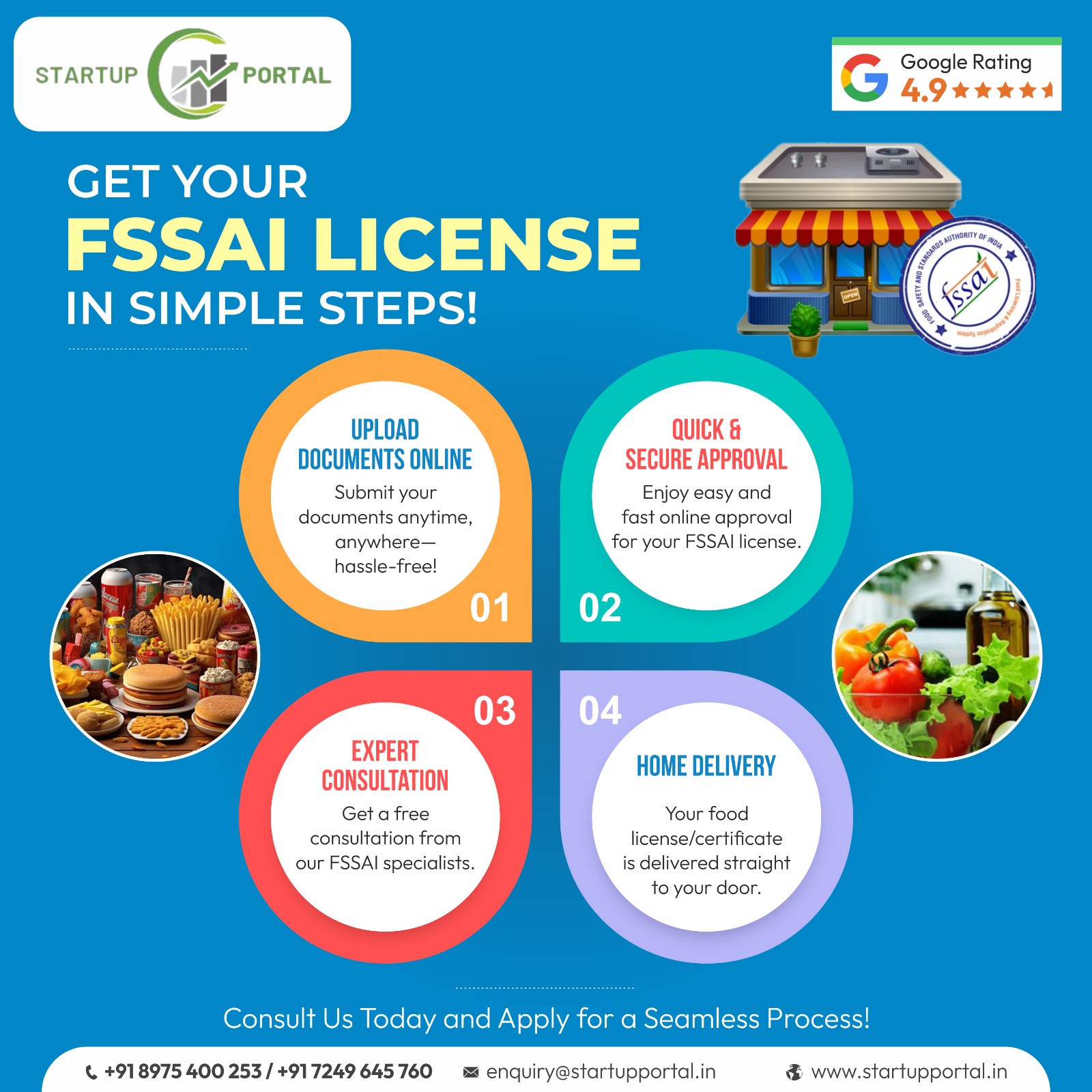

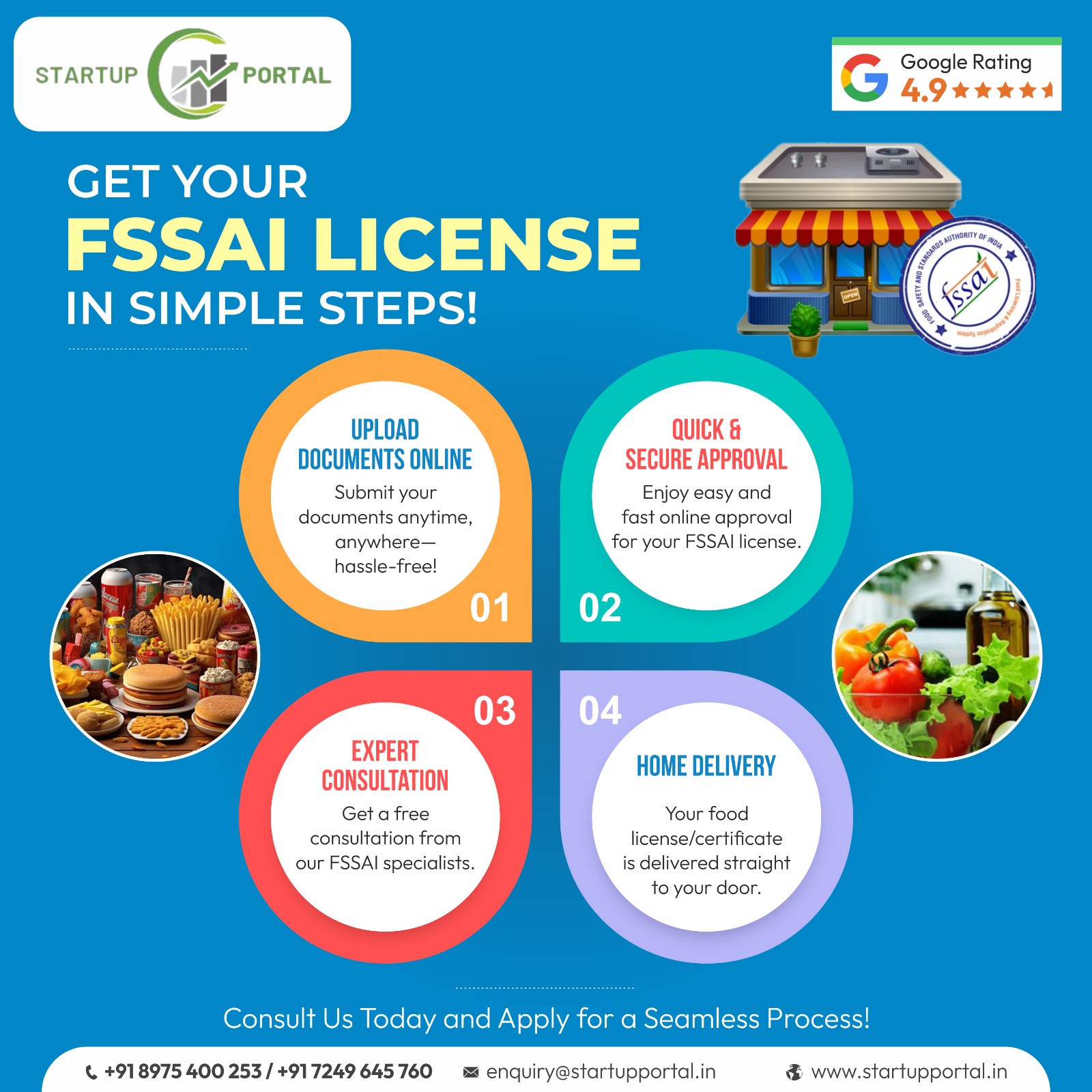

Startup portal 2025-07-04

A Complete Guide to Online Food License Registration in PuneIf you're planning to start a food business in Pune〞whether it*s a restaurant, food truck, cloud kitchen, or packaged food unit〞getting a food license is mandatory. Why You Need a Food LicenseA valid FSSAI food license ensures that your customers that your food products meet the quality and safety standards defined by law. Process of Online FSSAI Registration in PuneThanks to digital services, Online FSSAI Registration in Pune is now quicker and more accessible. That*s why we*ve helped hundreds of food businesses with Online Food License Registration in Pune〞on time and without hassle. Contact us today and get your online food license registration in Pune done smoothly!

How software helps:A good GST return filing software automatically syncs your GSTR-1 data and cross-checks it with GSTR-3B before submission. How software helps:Most GST software validates GSTINs using the GSTN database in real-time. How software helps: Advanced GST software offers auto-suggestions and code mapping, so you pick the right HSN/SAC every time. How software helps:With GST software, you can import data in bulk from Tally, Excel, or ERPs. How software helps:Premium GST software auto-compiles data from all 12 months and highlights any discrepancies for review.

Startup portal 2025-06-26

Whether you're a startup, an MSME, or an established enterprise in Pune, online trademark registration in Pune ensures your brand name, logo, slogan, or design is safeguarded against misuse. With the increasing demand for digital presence, registering your trademark online is not only efficient but also legally beneficial in asserting ownership. Benefits of Online Trademark Registration in PuneLegal Protection: Trademark registration offers exclusive usage rights and legal recourse against infringement. As trusted trademark consultants in Pune, we offer:Free preliminary trademark searchExpert guidance on class selectionEnd-to-end online trademark registration supportTransparent pricing with no hidden chargesTimely updates and reminders on trademark statusGet Started Today! Contact Startup Portal Business Services for hassle-free online trademark registration in Pune.

Instead of relying solely on private keys and native blockchain logic, account abstraction enables each account to operate with custom rules defined by smart contracts. With account abstraction, wallets can include built-in features such as multi-signature verification, social recovery, session keys, spending limits, and even gas abstraction. The Technical Foundation of Account AbstractionEthereum*s long-anticipated EIP-4337 (Ethereum Improvement Proposal 4337) is the driving force behind mainstream adoption of account abstraction. Real-World Use Cases of Account AbstractionIn the DeFi space, account abstraction allows users to interact with complex protocols through a single smart wallet interface. As more dApps embrace account abstraction, users will benefit from frictionless experiences, improved security, and greater control over their digital assets.