Sainath Deshmukh 2025-09-26

Choosing the right health insurance for elderly parents can feel overwhelming. As medical needs become more complex with age, and healthcare costs rise, having the right health insurance plan helps manage these expenses with less stress. Understand Their Medical NeedsStart by assessing your parents¡¯ current health conditions. Choose insurance plans accepted by a broad network of hospitals, especially those near your parents¡¯ home. They can help compare options and recommend policies suited to your parents¡¯ health profile and budgetSelecting the right health insurance for elderly parents takes careful planning.

The Medicators 2025-09-25

Regulatory & Tax Treatment of Dental Billing Services in TexasIn 2021, Texas passed HB 1445, which classifies ¡°medical or dental billing services¡± as exempt from sales and use tax. However, Medicaid billing poses special risks:Texas has conducted audits and investigations into dental providers suspected of overbilling, unnecessary orthodontic services, or improper claims. Risks & Illegal Billing PracticesDental practices in Texas must be vigilant of billing practices that may cross legal boundaries. Best Practices for Compliant Dental Billing in TexasTo reduce audit risk and ensure lawful billing, dental practices should follow these best practices:Maintain meticulous documentation: Treatment plans, progress notes, radiographs, consents¡ªeverything that supports the billed service. The Role of the Texas State Board of Dental ExaminersThe Texas State Board of Dental Examiners (TSBDE) regulates licensure and enforces professional standards for dentists, hygienists, assistants, and labs in Texas.

Chronic wound care billing is becoming increasingly complex as demand for advanced treatments grows. This blog highlights practical, data-driven approaches to streamline Chronic wound care billing, reduce denials, and maximize reimbursement. Partnering with experts in outsourcing wound care billing offers a strategic advantage. What role do modifiers play in wound care billing? How often should wound care billing processes be audited?

Limited Time to Build Credit: With years spent in school and training, many physicians haven¡¯t had time to build a long credit history. Rising Mortgage Rates in 2025: While physician mortgage loan rates are competitive, fluctuations can still impact affordability. Exploring Physician Mortgage Loan BenefitsA physician mortgage loan is specifically designed for doctors, residents, and sometimes dentists or veterinarians. Common First-Time Homebuyer Mistakes Physicians MakeEven with the right mortgage option, many physicians make avoidable mistakes during the buying process. 25% difference in physician mortgage loan rates can cost thousands over the life of the loan.

DWF DIRECT INSURANCE 2025-09-18

But family health insurance plans in Fort Worth can offer so much more beneath the surface. With individual family health insurance in Fort Worth, families can typically avoid the stress of endlessly searching for qualified doctors because the network is already extensive and vetted. With family health insurance, emergency room visits, urgent care, and even ambulance rides may be partially or fully covered. Mental Health ResourcesToday's family health plans often include counseling and therapy options. Wrapping UpThe true value of family health insurance plans in Fort Worth goes far beyond what¡¯s listed on the surface.

One area where practices face repeated denials is the incorrect use of billing modifiers¡ªespecially Modifier 95. This guide breaks down when to use Modifier 95, when not to use it, and the exact steps to bill it correctly, so you can streamline reimbursement and avoid claim denials. When to Use Modifier 95Use Modifier 95 for any service conducted via synchronous telehealth technology. When NOT to Use Modifier 95Avoid Modifier 95 in cases where the requirements for real-time audio and video are not met. For error-free claims and reliable revenue flow, consider outsourcing telehealth billing and coding services to experts like 24/7 Medical Billing Services.

The Latin America health insurance market size was estimated at USD 86. Get a preview of the latest developments in the Latin America Health Insurance Market! Key Companies & Market Share InsightsThe private health insurance market in Latin America is becoming highly competitive as companies use strategic initiatives such as alliances to grow their customer base and expand their market share. Some prominent players in the Latin America health insurance market include:BUPAMAPFREEMPRESAS BANM?DICASAGICOR LIFE INSURANCE COMPANY (SAGICOR)ALLIANZ CAREASSICURAZIONI GENERALI S. AXACHUBBGRUPO NACIONAL PROVINCIAL (GNP)Gather more insights about the market drivers, restrains and growth of the Latin America Health Insurance Market

Chishti Private Equity 2025-08-29

If you¡¯re looking for a stylish, safe, and practical way to enhance your staircase, Cosy Homeer non-slip stair treads are the perfect solution. What Are Cosy Homeer Non-Slip Stair Treads? The Cosy Homeer Soft Stair Treads 15pcs Set is a premium stair mat solution designed specifically for wooden steps. Key Features of Cosy Homeer Edging Stair TreadsLet¡¯s take a closer look at what makes Cosy Homeer edging stair treads a top-rated choice for homeowners:1. There are many stair treads available on the market, but Cosy Homeer non-slip stair treads stand out for several reasons:Trusted Brand: Cosy Homeer is known for high-quality home products that are functional and affordable.

Healthinsurance 2025-08-29

For many part-time workers, health insurance is one of the biggest challenges. Catastrophic Health PlansCatastrophic health insurance is tailored for younger, healthier people who want low monthly premiums and protection against worst-case scenarios. Short-Term Health InsuranceShort-term health plans are another alternative, although they come with some caveats. The Role of a Health Insurance Consultant in VirginiaIf you¡¯re based in Virginia and juggling part-time work with limited benefits, a Health Insurance Consultant in Virginia can make the process easier. For tailored guidance, working with a Health Insurance Consultant in Virginia can help you zero in on the best solution.

PingTree Systems 2025-09-24

This critical challenge is precisely where robust Lead Distribution Systems prove their indispensable value. Effective lead distribution goes beyond just speed; it's about intelligent allocation. This data empowers businesses to continually refine their lead generation and distribution strategies, identifying what works best and optimizing for sustained growth. In conclusion, the direct link between faster follow-up and higher conversions is undeniable, and the linchpin in achieving this critical synergy is an intelligent lead distribution strategy. It transforms your sales process from reactive to proactive, ensuring every potential customer receives the timely and expert attention they deserve.

The global livestock insurance market was valued at USD 3. This heightened awareness has contributed to the rising demand for livestock insurance. Moreover, bovine insurance helps offset financial losses from disease outbreaks by covering mortality, treatment costs, and biosecurity measures, further fueling segment growth. Get a preview of the latest developments in the Global Livestock Insurance Market! Key Market PlayersProminent companies operating in the global livestock insurance market include:Gather more insights about the market drivers, restrains and growth of the Livestock Insurance Market

The pet insurance market is poised for significant growth by 2032, driven by increasing pet ownership, rising veterinary costs, and growing awareness of pet health and wellness. The global pet insurance market size was valued at USD 11 Billion in 2024 to USD 38. Employer-Sponsored Pet Insurance: Some companies are now offering pet insurance as part of employee benefits, adding a new dimension to market growth. za Embrace Pet Insurance Agency, LLC Figo Pet Insurance LLC Hartville Group Healthy Paws Pet Insurance LLC Hollard Pet Insurance ManyPets Medibank Private Limited MetLife (PetFirst Healthcare LLC) Nationwide Building Society (Pet Insurance Division) OnePlan Health Insurance Oriental Insurance Company Ltd PetBest Insurance PetHealth Inc. Future OutlookBy 2032, the pet insurance market is expected to become a mainstream component of pet ownership, much like health insurance for humans.

section125group 2025-05-22

Understanding Supplemental Health Insurance: A Comprehensive Exploration

Supplemental health insurance serves as an essential buffer against the financial uncertainties that can arise from medical expenses not covered by primary insurance plans. Unlocking the Benefits of Supplemental Health Insurance: Enhancing Healthcare Coverage

Supplemental health insurance offers numerous advantages that significantly enhance existing healthcare coverage. How Supplemental Health Insurance Complements Existing Coverage: Bridging the Gaps

Designed to work in tandem with primary health insurance, supplemental health insurance fills in the gaps by providing additional support where needed. Secondary Health Insurance: An In-Depth Overview

Secondary health insurance, often synonymous with supplemental insurance, provides additional coverage beyond primary health insurance plans. Conclusion: The Vital Role of Supplemental Health Insurance

Supplemental health insurance plays a pivotal role in enhancing overall healthcare coverage.

PingTree Systems 2025-09-17

It's time to stop chasing and start closing, harnessing the power of a unified Solar Leads Generation Platform. The principle of unified lead management extends far beyond the solar or mortgage sectors. A unified platform pulls all your solar leads into one intuitive dashboard, providing a complete 360-degree view of every prospect. In a competitive market, adopting a unified solar leads platform isn't just about streamlining operations; it's about gaining a significant competitive edge. To explore how a cohesive lead generation and management system can revolutionize your solar sales process, reach out to Pingtree Systems Private Limited.

Why Families Need Individual Health Insurance Plans? The most important reason to consider individual health insurance plans is the personalised coverage they offer. Nationwide Hospital AccessA wide hospital network is one of the most valuable features of modern health cover. The Role of Cashless Medical Insurance in IndiaOne of the most valuable features of today¡¯s policies is the availability of Cashless Medical Insurance India. With individual health insurance plans, families get personalised protection, while cashless medical insurance in India ensures convenience and financial relief.

PingTree Systems 2025-09-03

In today's hyper-connected digital landscape, lead generation is the lifeblood of many businesses, none more so than the legal sector. The principles of ethical lead generation extend far beyond product liability, permeating every niche where trust is paramount. The Indispensable Pillars of Ethical Lead GenerationEthical lead generation is not a vague concept but a practical framework built on several core principles:1. Value-Driven Engagement: Instead of aggressive sales pitches, ethical lead generation focuses on providing value. Implementing Ethics at the Core of Your PlatformEmbedding ethics into a lead generation platform involves more than just policy statements.

PingTree Systems 2025-09-11

This is where the true power of smart lead distribution comes into play, transforming raw inquiries into highly qualified, perfectly routed opportunities. The operational mechanics behind smart lead distribution are often powered by advanced technology. The advantages of adopting smart lead distribution are multifaceted and directly impact a company's bottom line. Implementing a smart lead distribution strategy requires careful planning. Moving beyond basic round-robin to intelligent lead distribution is not just an upgrade; it's a strategic imperative for businesses aiming for sustainable growth and unparalleled sales efficiency.

Columbus Insurance Services 2d

Whether you're exploring commercial health insurance options or seeking personalized coverage from a local insurance company Columbus MS, making informed decisions tailored to your needs is crucial. Why Choose a Local Insurance Company Columbus MS? While national insurance providers offer a broad range of policies, opting for a local insurance company Columbus MS has distinct advantages. ConclusionWhether you¡¯re a business owner seeking commercial health insurance or a homeowner looking for the best home insurance company MS, the Columbus, MS, insurance market offers a variety of options tailored to your needs. Working with a local insurance company Columbus MS ensures personalized service and a deep understanding of regional requirements.

Whether you¡¯re a young adult, a working professional, or a retiree, understanding health insurance and how it works is key to making informed decisions about your health and financial well-being. Why Health Insurance Is ImportantHealth insurance provides several essential benefits:Key Terms to UnderstandNavigating health insurance can be confusing due to the terminology involved. Here are a few key terms:Types of Health Insurance PlansThere are several types of health insurance plans, each with its pros and cons:Choosing the Right PlanWhen selecting a health insurance plan, consider the following factors:Health Insurance and the LawIn many countries, including the United States, health insurance is not just a personal choice¡ªit is tied to public policy. By understanding how health insurance works and evaluating your personal healthcare needs, you can choose a plan that offers the right balance of cost, coverage, and convenience. In an era where health and wellness are more important than ever, having reliable health insurance is not just a smart choice¡ªit¡¯s a vital one.

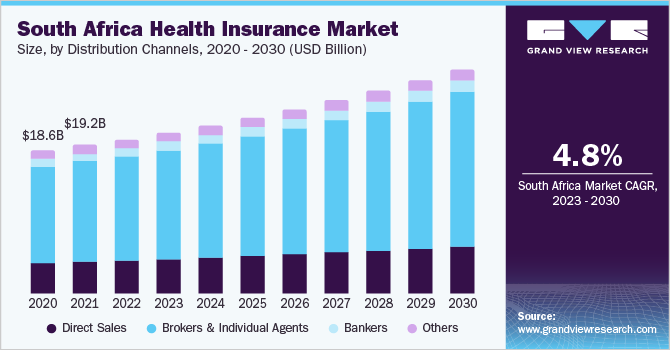

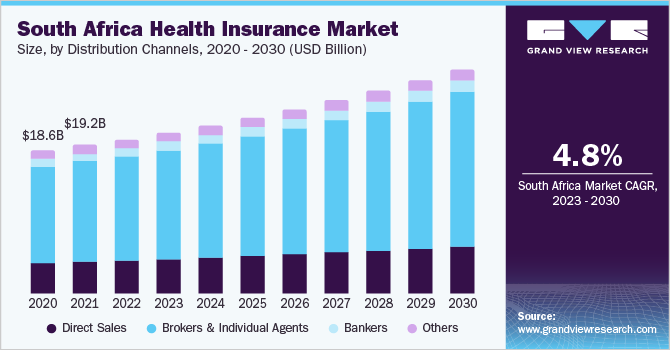

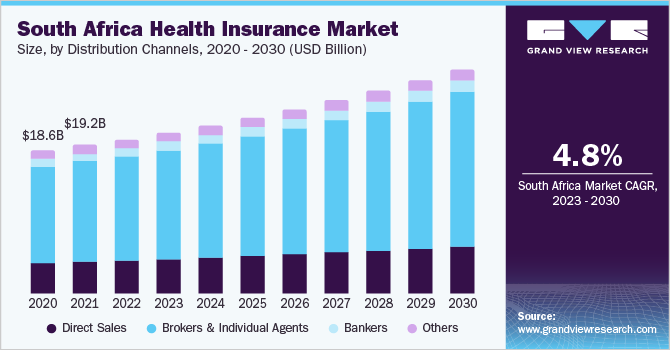

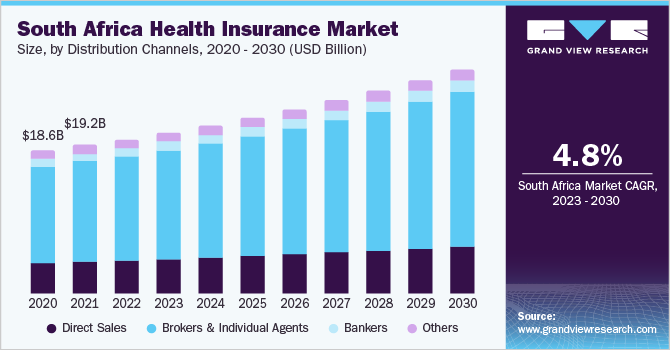

The Africa health insurance market size is anticipated to reach USD 50. Moreover, in July 2023, Sanlam entered into a partnership with Aetna Internationalto offer Africa¡¯s most comprehensive health insurance plan. The major market share of the continent's health insurance industry is made up of five nations: South Africa, Namibia, Kenya, Morocco, and Egypt. Get a preview of the latest developments in the Africa Health Insurance Market! This is attributed to robust government support and the growing number of key playersList of Key Players in the Africa Health Insurance MarketSantamAllianz CareCigna GlobalAetna InternationalGlobality HealthBupa GlobalClements WorldwideGlobal UnderwritersIMGInsured NomadsGather more insights about the market drivers, restrains and growth of the Africa Health Insurance Market